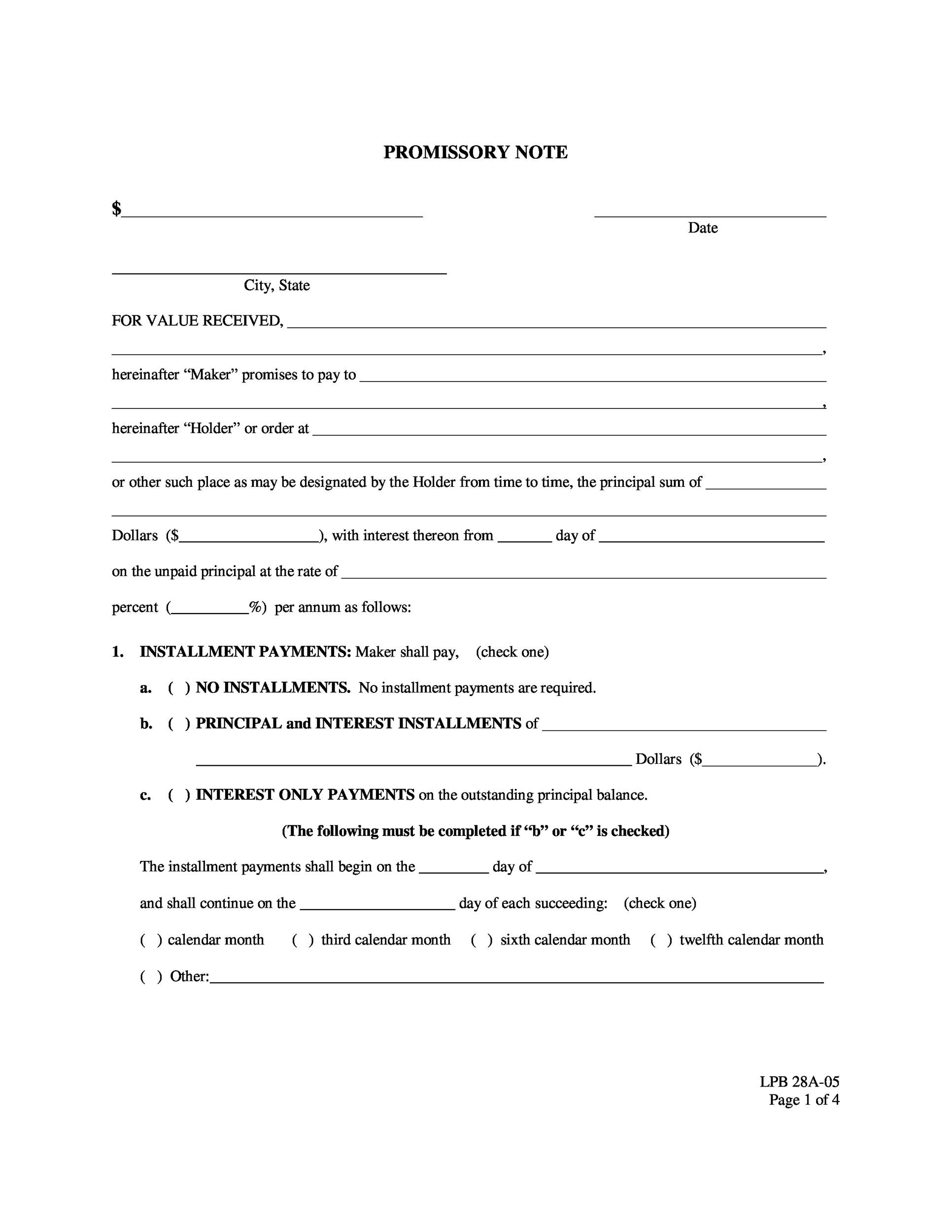

Interest rates for typical loan agreements are specified as an annual or monthly number. – Interest RateĮssentially, the interest rate calculates the loan payment to make on the loan term. Then, at the end of the loan term, it is typical that the remaining principal of the loan is paid off in full. Also, how often the loan payments will need to be made. – Loan Termįirstly, the term of the loan specifies how long the loan will be active.

#Templates for invoices for promissory notes update

Then, as the loan gets paid down, the principal balance will update to reflect the balance remaining. The principal amount to borrow is the actual money that will be lent to the borrower at the beginning of the loan. Details of the parties involved:Ī promissory note must include the details of the parties including their legal names, the contact details of both including the addresses of all parties who are involved in the transaction. Investors are usually taking on significant risk with the expectancy of a greater return as these bypass traditional forms of lending and formal institutions such as banks as well. Especially in the off-chance that late payments or defaults are a possibility. Importantly, always ensure that the payment details are explicit. As well as the amount that needs to be borrowed, and other terms and conditions for repayment.

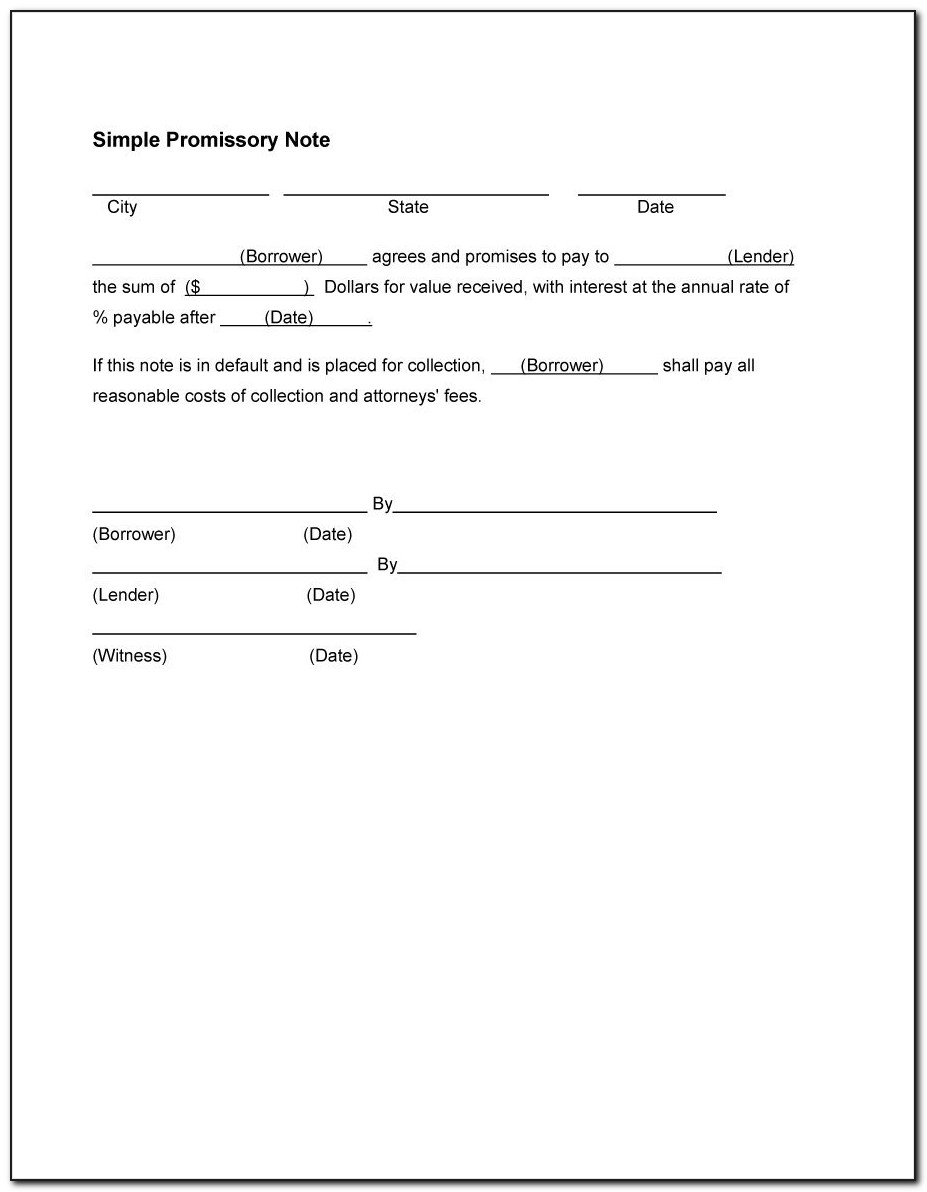

What is in a Promissory Note?Įssentially, all loan agreements will contain details about the borrower and lender. There are generally three parties involved in a promissory note. For secured notes, no collateral is required. The value of the collateral needs to be equal to or more than the amount being borrowed. For secured notes, the borrower should provide collateral. There are generally two types of promissory notes: secured and unsecured notes. Promissory notes are also transferable and can be sold to another. In cases where this is not done, the lender has to do their analysis and trust and that company is capable of servicing the debt. Given that they are informal loans of a sort, these notes are subject to review by regulators, who will evaluate if a company can meet the mentioned promise of return.

For businesses, it is typically a means of short-term financing. Thus, a promissory note is essential for this. In all cases, lenders will want assurance of repayment. Conversely, a personal loan is secured by the income and assets of the individual requesting a loan. This is a contract between a borrower, who is looking for money and a lender, who is willing to provide the capital to the borrower.Īdditionally, a commercial sample promissory note is one by which a company acts as a borrower. The right letters, notices, and policies can really help you do it right when it comes to recruiting and hiring, managing employee reviews, and reacting to disciplinary or other unexpected situations.A sample Promissory Note is a loan agreement or a debt instrument. The people who work for you are your greatest asset.

0 kommentar(er)

0 kommentar(er)